AG Insurance and AG Real Estate welcome Northleaf, Hedera and TINC as co-shareholders of Interparking

AG Insurance and its real estate subsidiary AG Real Estate announce the arrival of three new co-shareholders in Interparking – Northleaf, Hedera and TINC/Infravest – following the syndication of a minority part of their stake in the leading European parking provider.

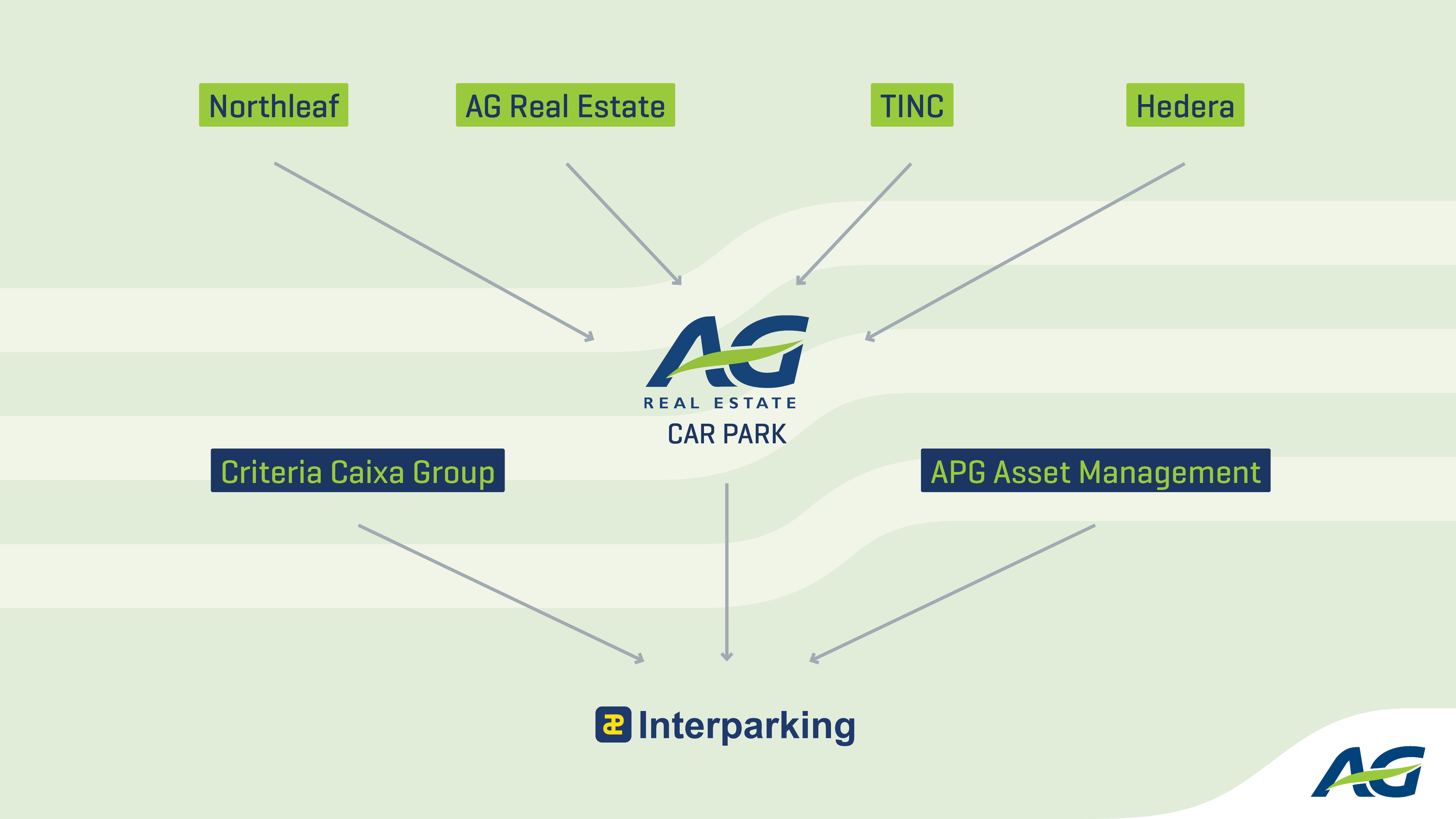

These three investors will become co-shareholders in a newly created company (AG Real Estate Car Park SA) which will regroup the stakes in Interparking historically owned by AG Insurance and AG Real Estate (together "AG"). This new company is majority-owned by AG, with funds managed by Northleaf Capital Partners, Hedera and TINC/Infravest each holding a minority stake.

Following the transaction, AG Real Estate Car Park will remain the majority shareholder of Interparking, with the remaining shares in Interparking owned by APG Asset Management and CriteriaCaixa. This structure ensures that AG retains exclusive control of AG Real Estate Car Park and therefore also of Interparking.

AG, together with the new and existing shareholders, will continue to support the stability and growth prospects of Interparking, which enters a new and significant chapter in its nearly 70-year history following the recent acquisition of Saba. This alliance has created a leading pan-European player in the public parking sector, now present in 16 countries and operating more than 2,000 car parks, representing nearly 800,000 spaces.

Heidi Delobelle, CEO of AG: “As an insurer, AG aims for active yet prudent management of its investment portfolio, always ensuring optimal diversification across sectors, regions and financial instruments. This approach allows us to sustainably balance risk and return and to honor our long-term commitments to our clients. The syndication of our shares in Interparking is part of this thoughtful strategy, enabling us to further optimize our portfolio, while bringing strong shareholders into Interparking.”

Serge Fautré, CEO of AG Real Estate: “AG Real Estate is proud to finalize this syndication following up on the acquisition of Saba, which reflects our commitment to strengthening a solid and sustainable shareholder base. This transaction aligns with our strategy of portfolio optimization and diversification, focusing on assets that generate stable and recurring income. Beyond the parking industry, we reaffirm our commitment to long-term investments by combining economic performance with responsible vision. Interparking fits perfectly into this approach, offering solutions to address mobility challenges in major European cities. We are proud, together with Interparking’s management, to support the future of a group with Belgian anchorage.”

Roderick Gadsby, Managing Director & Head of European Infrastructure of Northleaf: “Interparking is an excellent fit with Northleaf’s infrastructure investment strategy and complements our broader portfolio of high-quality, mid-market infrastructure assets in select OECD countries. This investment provides our investors exposure to stable, predictable cash flows in an attractive sector. We are pleased to expand our presence in the transportation sector in Europe and to support Interparking and its leading pan-European portfolio."

Alberto Fernandez Fernandez, Chairman of the Management Committee of Hedera: “Hedera has been entrusted with securing the long-term financing of our country’s nuclear liabilities, ensuring that this financial burden will not fall on future generations. Fulfilling this mandate requires to build a resilient portfolio of strategic assets capable of delivering stable and predictable returns over several decades. Interparking’s essential infrastructure, strong Belgian and European footprint and commitment to sustainable mobility make it precisely the type of long-term, future-proof investment that enables Hedera to carry out its public mission in the interest of generations to come.”

Manu Vandenbulcke, CEO of TINC: “This investment provides TINC with access to long-term cash flows in a sector that is a key contributor in the transition toward smart and sustainable mobility solutions. TINC made its first entry into the car park sector in 2012 with the acquisition of the Eemplein car park in the Netherlands, which remains part of our portfolio today. With this investment in Interparking, complemented by our reference shareholder Infravest, we are seizing the opportunity to further increase our exposure to the sector. Interparking has demonstrated consistent growth under the stewardship of AG Insurance and AG Real Estate, and hence we are pleased to join a strong and supportive group of shareholders”

In connection with this transaction, AG Insurance and AG Real Estate were advised by BNP Paribas and Rothschild & Co, and by Cleary Gottlieb. Northleaf was advised by Jefferies and Sidley Austin. Hedera was advised by SFPIM, Liedekerke and Eubelius. TINC and Infravest were advised by ABN AMRO and Freshfields.

The completion of this transaction is expected in December 2025. Financial details of the transaction will not be disclosed.

Press Contacts:

For AG Insurance: Lars Vervoort – lars.vervoort@aginsurance.be – +32 472 610 935 / Laurence Gijs – laurence.gijs@aginsurance.be – +32 479 81 46 81

For AG Real Estate: Amand-Benoît D’Hondt – amand.dhondt@agrealestate.eu - +32 477 886 897 / Aurore Moens – aurore.moens@agrealestate.eu – +32 26 096 603 / Roxane Decraemer – roxane.decraemer@agrealestate.eu – +32 26 096 737

For Northleaf: Gina Lee - gina.lee@northleafcapital.com – +1 416 389 7667 / Prosek Partners - Pro-northleaf@prosek.com

For TINC: Manu Vandenbulcke - manu.vandenbulcke@tdpartners.com – +32 3 290 21 73 / Filip Audenaert – filip.audenaert@tdpartners.com – +32 3 290 21 73

About AG Insurance

AG Insurance is a major player in the Belgian insurance market in Life and Non-Life. To better tailor its offer to fulfil different customer needs, AG Insurance has a multi-channel distribution strategy that includes independent brokers and bank branches (BNP Paribas Fortis) and collaboration with large corporate clients and sectors for their group insurance. AG Insurance employs over 4,400 specialised staff members.

For more information, visit www.ag.be

About AG Real Estate

AG Real Estate, a wholly-owned subsidiary of AG Insurance, is an integrated property operator active in Belgium, France, Luxembourg and on certain select European markets with expertise in Office, Retail, Logistics and Residential investment/development, PPP and real estate financing, as well as Car Park Management through its subsidiary Interparking and Nursing homes via its wholly-owned subsidiary Anima. A company active in urban real estate, AG Real Estate has more than 250 employees with varied profiles and areas of expertise. With a portfolio of more than €6.5 billion under management for its own account and on behalf of third parties, AG Real Estate is endeavouring to provide a responsible response to new urban needs and to implement a sustainable development policy as to make its projects even more meaningful.

For more information, visit www.agrealestate.eu

About Northleaf

Northleaf Capital Partners is a global private markets investment firm with more than US$30 billion in private equity, private credit and infrastructure commitments raised to date from public, corporate and multi-employer pension plans, endowments, foundations, financial institutions and family offices. Northleaf’s 285-person team is located in Toronto, Chicago, London, Los Angeles, Melbourne, Menlo Park, Montreal, New York, Seoul and Tokyo. Northleaf sources, evaluates and manages private markets investments, with a focus on mid-market companies and assets.

For more information, please visit www.northleafcapital.com

About Hedera

Hedera is a public body that embodies Belgium’s commitment to responsibly managing the financial legacy of the nuclear sector and protecting future generations from the burden of the costs for the long term management of nuclear waste and spent fuel. Hedera operates under a long-term public-interest mandate, working closely with federal authorities and key stakeholders to ensure that Belgium’s nuclear legacy is financed in a transparent and sustainable manner. To fulfil this mission, Hedera builds and manages a resilient portfolio of strategic, high-quality assets capable of generating stable and predictable returns over several decades. Its investment strategy focuses on sectors that contribute strategically to the Belgian economy and its long-term resilience.

About TINC

TINC is a Belgian listed investment company that aims to create sustainable value by investing in the infrastructure for the world of tomorrow. TINC participates in companies involved in developing and operating infrastructure and maintains a diversified portfolio of investments in focus areas such as public infrastructure, energy infrastructure, digital infrastructure, and social infrastructure in Belgium, France, Ireland, and the Netherlands.

For more information: www.tincinvest.com

About Infravest

Infravest is a strategic cooperation between Gimv, WorxInvest and Belfius in view of anchoring and continuing the reference shareholding of TINC as a listed investment company active in infrastructure.